One of the most challenging task of a homemaker is budget. I know, it is tough, even for an Accountant and an Accountant’s wife, like me. Let me share with you some practical tips on budgeting and money-handling that we had been practicing in our household for quite some time:

1. Empty your payroll account

Yup, you read it just right. Once you receive your pay for the month, bi-monthly or weekly, I suggest taking it all out from your account. My reason for this?

(a) Payroll accounts do not bear interest. It will be useless to leave it there and not earn anything

(b) It will be easier to account for salary/pay when it is empty when replenished;

(c) Having all your money will make it easier to allocate your funds

Emptying does not necessarily mean, withdrawing, it can also mean transferring to your savings account or fund account (I will discuss this later).

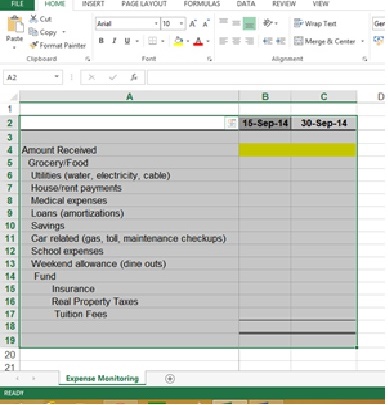

It is easier to control your spending when you have properly allocated your money. In that way you set aside your money for important expenses and do not forget anything and end up spending it to something else. An excel spreadsheet will be helpful or a notebook, probably? I prefer an excel worksheet so I can just copy and paste to the coming months. Set uniform allocations on a monthly basis so you will be on track. Setting a level for grocery, utilities, and other expenses will help you know if your spending is still within the range.

3. Savings must be part of your “expenses”

More often than not, we consider savings as an excess. Well, there is usually no excess, right? Rather than waiting for all payments to be made before

having that much wanted savings, treat savings as part of your “usual”expenses. Set a reasonable amount per pay day and deposit it to your savings account, or to any account other than your payroll. It may be tough to keep this amount in the first few months but when you get the hang of your allocations, you will be surprised with how quickly you can build your savings with this.

4. Buy what you can pay NOW.

Having that plastic money conveniently on your pocket makes it easier to spend. However, since your money stays intact, often times it is easy to lose track of your credit card purchases. You may buy a pair of shoes now and forgot about it a week after and you will end up buying a dress thinking you have extra funds. By the time your bill comes, you will be surprised to see these two items, or even more. So for leisure and non-necessity items, buy only what you can pay through cash. When we take money out of our wallets, we think twice. In time, you will realize how much you can save by practicing this lifestyle.

4. Plan major expenses

There are expenses that you usually pay on a quarterly, semi-annual or yearly basis that are expensive such as insurance, real property taxes, mortgages, etc… So as not to get all surprised when the bill come, build funds for these type of expenses. Get the expected amount and spread it for a period of time, say for 6 months or 1 year and include it in your monthly allocations. By the time these payments are due, you have enough funds to cover for it.

5. Set reasonable and realistic expense budget

Do not set goals you can not keep. Be realistic and be honest. Being true to yourself will be help you assess which items you can maintain, and which ones you can scrimp on. Remember, the more stringent your goals are, the harder it is to keep. Usually, when you break it, you will tend to be frustrated and end up not giving up on your financial goal.

Just like in everything, practice makes perfect. It may take time for you to be able to fully adjust to this system but it really works. Just have the patience and the will to abide by your goals. Discuss it with your family as well so they will be with you in this goal.

Good luck!